For a glimpse of what awaits Britain, Europe, and America as budget deficits spiral to war-time levels, look at what is happening to the Irish welfare state.

By Ambrose Evans-Pritchard | UK Telegraph

Events have already forced Premier Brian Cowen to carry out the harshest assault yet seen on the public services of a modern Western state. He has passed two emergency budgets to stop the deficit soaring to 15pc of GDP. They have not been enough. The expert An Bord Snip report said last week that Dublin must cut deeper, or risk a disastrous debt compound trap.

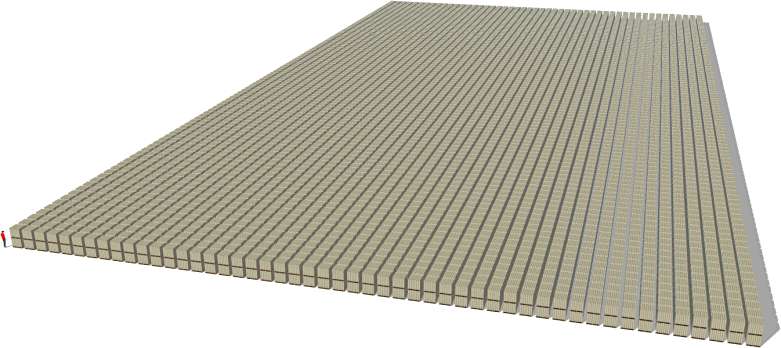

A further 17,000 state jobs must go (equal to 1.25m in the US), though unemployment is already 12pc and heading for 16pc next year.

Education must be cut 8pc. Scores of rural schools must close, and 6,900 teachers must go. “The attacks outlined in this report would represent an education disaster and light a short fuse on a social timebomb”, said the Teachers Union of Ireland.

Nobody is spared. Social welfare payments must be cut 5pc, child benefit by 20pc. The Garda (police), already smarting from a 7pc pay cut, may have to buy their own uniforms. Hospital visits could cost £107 a day, etc, etc.

“Something has to give,” said Professor Colm McCarthy, the report’s author. “We’re borrowing €400m (£345m) a week at a penalty interest.”

No doubt Ireland has been the victim of a savagely tight monetary policy – given its specific needs. But the deeper truth is that Britain, Spain, France, Germany, Italy, the US, and Japan are in varying states of fiscal ruin, and those tipping into demographic decline (unlike young Ireland) have an underlying cancer that is even more deadly. The West cannot support its gold-plated state structures from an aging workforce and depleted tax base.

As the International Monetary Fund made clear last week, Britain is lucky that markets have not yet imposed a “penalty interest” on British Gilts, given the trajectory of UK national debt – now vaulting towards 100pc of GDP – and the scandalous refusal of this Government to map out any path back to solvency.

“The UK has been getting the benefit of the doubt, both in the Government bond market and also the foreign exchange market. This benefit of the doubt is not going to last forever,” said the Fund.

France and Italy have been less abject, but they began with higher borrowing needs. Italy’s debt is expected to reach the danger level of 120pc next year, according to leaked Treasury documents. France’s debt will near 90pc next year if President Nicolas Sarkozy goes ahead with his “Grand Emprunt”, a fiscal blitz masquerading as investment.

There was a case for an emergency boost last winter to cushion the blow as global industry crashed. That moment has passed. While I agree with Nomura’s Richard Koo that the US, Britain, and Europe risk a deflationary slump along the lines of Japan’s Lost Decade (two decades really), I am ever more wary of his calls for Keynesian spending a l’outrance.

Such policies have crippled Japan. A string of make-work stimulus plans – famously building bridges to nowhere in Hokkaido – has ensured that the day of reckoning will be worse, when it comes. The IMF says Japan’s gross public debt will reach 240pc of GDP by 2014 – beyond the point of recovery for a nation with a contracting workforce. Sooner or later, Japan’s bond market will blow up.

Error One was to permit a bubble in the 1980s. Error Two was to wait a decade before opting for monetary “shock and awe” through quantitative easing.

The US Federal Reserve has moved faster but already seems to think the job is done. “Quantitative tightening” has begun. Its balance sheet has contracted by almost $200bn (£122bn) from the peak. The M2 money supply has stagnated since January. The Fed is talking of “exit strategies”.

Is this a replay of mid-2008 when the Fed lost its nerve, bristling over criticism that it had cut rates too low (then 2pc)? Remember what happened. Fed hawks in Dallas, St Louis, and Atlanta talked of rate rises. That had consequences. Markets tightened in anticipation, and arguably triggered the collapse of Lehman Brothers, AIG, Fannie and Freddie that Autumn.

The Fed’s doctrine – New Keynesian Synthesis – has let it down time and again in this long saga, and there is scant evidence that Fed officials recognise the fact. As for the European Central Bank, it has let private loan growth contract this summer.

The imperative for the debt-bloated West is to cut spending systematically for year after year, off-setting the deflationary effect with monetary stimulus. This is the only mix that can save us.

My awful fear is that we will do exactly the opposite, incubating yet another crisis this autumn, to which we will respond with yet further spending. This is the road to ruin.