Top 25 Comercial Banks have $201 Trillion in Derivatives but only $7.7 Trillion in Assets

You rarely hear about the true nature of the dilemmas our financial system faces. Only recently, as the real economy begins to implode, do the financial media talking heads even discuss such matters. Judging by the lack of concern amongst most of the people out there; they probably do not realize just what kinds of sums we are dealing with.

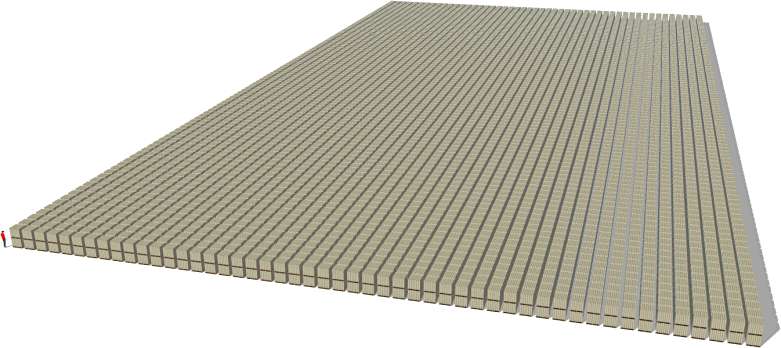

Here is what 1 Trillion dollars would look like, in hundred dollar bills, on forklift pallets double stacked:

1 Trillion Dollars in Hundred Dollar Bills on Forklift Pallets

Imagine $201 Trillion Dollars on forklift pallets; because that is the number that our top commercial banks are toying around with on a daily basis.

With this in mind, doesn’t it seem comical that the U.S. Federal Government is adding new spending programs including a national health-care plan? In the future, everything will be paid for with confetti dollars!

Warning: AIG collapse could trigger new crisis!!

AIG, once world largest insurance firm whose derivatives unit still has more than $1 trillion of exposures that need to be unwound while keeping losses under control.

Saying “derivatives are dangerous,” Warren Buffett

“Derivatives at the heart of the crisis, catastrophic losses are inevitable, financial system headed for oblivion, the new world disorder, EU doomed, Credit Default Swaps at the heart of the problem, Plunge Protection Team history, coverups for globalization failures, Bloodbath for the Yen…

The heart of the current crisis is the quadrillion plus derivative market. Roughly half of these derivatives are listed on exchanges, but the other half are on the totally unregulated, totally opaque, poorly documented and mostly naked (no reserves or collateral given to secure performance) OTC derivatives market.

….

It is only fitting that the credit-default swaps lie at the heart of the problem, which the fraudster banks now face. When you look at what has been done by these reprobates in the past, this is a most fitting fate for them. First, they had President Reagan pass an Executive Order in 1988 forming the President’s Working Group on Financial Markets so they could manipulate markets 24/7 with the PPT. That was forced by the 1987 Stock Market Crash, an event orchestrated by the Illuminati to convince everyone that we had to have an interventional team to stop such extreme market gyrations.”Do you realized if AIG collapse, it’s massive derivatives could flow into the market and sharply drop in value.

If so, people would start questioning the value of derivatives held by other banks which ordinary people couldn’t imagine the size of those are:Total outstanding derivatives for the top 25 commercial banks was $201,502,177 Million (translated….$201.5 TRILLION)

Total Assets for the top 25 commercial banks was $7,707,703 Million (translated….$7.7 TRILLION)

The top three banks are summarized below (in $millions)

JPMORGAN CHASE BANK NA OH….. Total Assets: $1,688,164 ($1.6 TRILLION)…..Total Derivatives $81,161,463 ($81.1 TRILLION)

GOLDMAN SACHS BANK USA NY……Total Assets $161,455…..Total Derivatives $39,927,511

BANK OF AMERICA NA NC…..Total Assets……$1,434,037…..Total Derivatives $38,864,033

NOW THE SCARY PART! (verbatim from the OCC report)

============================================

“AIG said Friday that the notional value of its derivatives portfolio was $1.3 trillion at the end of June. That was down 13% from the end of the first quarter. The insurer said it reduced the number of positions in the portfolio by 20% to roughly 22,500.”

AIG rush to unload it’s derivatives asset as quick as possible, 13% down in value of it’s derivatives in a quarter doesn’t sound very pretty.

What is the signal, banks may unloading it’s derivatives as well, soon we will see this derivatives time bomb goes off even they already doing damage control by unloading them. Total outstanding derivatives for the top 25 commercial banks was $201,502,177 Million (translated….$201.5 TRILLION).

======================================

“The most urgent matter for Treasury to address is the toxic derivatives market. The notional amount of outstanding derivatives, as noted by the Bank of International settlements, comes close to $512 trillion. This represents a figure that is impossible to settle and is the real Armageddon which Banks are preparing for by hoarding the cash that they have received through the T.A.R.P..Unless this time bomb is defused by bringing the undeclared positions on the table, the duration and gravity of this crisis can only increase.”

Although AIG is struggling to survive and continuous to pay billions for key staff to hold off this time bomb, but I believe the crisis will soon emerge to the market as banks already start unloading their derivative position. I don’t think many people seem to realize the risks involved with derivative, the danger of derivative collapse could be devastating!

AIG received as much as $180 billion bailout and suffering stunning $62 billion quarterly loss, and it still paying billions for it’s staff, now it doesn’t sound weird to you, does it?

Tags: Breakdown Crisis, Economic Collapse, Economy

Simply want to say your article is as astounding.

The clarity in your post is simply great and i could assume you are an expert on this

subject. Fine with your permission let me to grab your RSS feed to keep

up to date with forthcoming post. Thanks a million and

please keep up the rewarding work.