Archive for the ‘Economy’ Category

Hyperinflation in USA by 2010

Judging by the way they are spending money in Washington DC, you’d think these politicians and central bankers are living in a fantasy world. When you give a government the ability to borrow endless sums of money, you tend to get this kind of disconnect from reality.

What the people don’t seem to realize is the fact that money creation is a hidden tax. When they do this reckless kind of spending; it isn’t magically creating new wealth to add to the system. Instead, it is actually stealing from the people who save their money and lowering the standard of living for the middle/lower class.

The Federal Government is overrun by thieving, self-serving scoundrels who pass ridiculously expensive, unrealistic and unconstitutional legislation. They stand up in front of the population, with a straight face, and tell them the new programs are actually going to save them money; however, history shows that these kinds of claims are rarely true. In fact, government programs usually cost many multiples of the amounts estimated by government bean counters.

The populace of this country is now dominated by left-wing socialists, who fail to understand the economic trouble we are in. All you need to do, in order to spend us further into the ground, is throw the plethos a few crumbs. In the case of “health care reform,” they gave pre-existing condition reform and a few other reforms which were sought by a fair chunk of the population. There is no doubt that reform was needed; but this reform further destabilizes both the health care system and even more pivotally, the economy.

There is a very strong chance that we will have hyperinflation in the United States of America sooner rather than later.

Healthcare Bill to Cause U.S. Hyperinflation By 2015

FORT LEE, N.J., March 20 /PRNewswire/ — The National Inflation Association – http://inflation.us – today issued a warning to all Americans of a potential outbreak of hyperinflation in the U.S. by year 2015 caused primarily by the healthcare bill and rising interest payments on our national debt.

Medicare was created in 1966 at a cost of $3 billion per year and the House Ways and Means Committee estimated in 1966 that in 1990 the cost of Medicare would reach $12 billion per year. Instead, the actual cost of Medicare in 1990 was $107 billion (792% more than what was projected) and today Medicare costs $408 billion annually. In 2003, the White House Office of Management and Budget estimated that the Iraq War would have a total cost of $50 to $60 billion. So far, we have already spent $713 billion on the Iraq War (over 1,000% more than what was projected).

The Congressional Budget Office is estimating that the healthcare bill will cost $940 billion over the next 10 years, but if history is any indication, the actual cost will likely be several trillion dollars. NIA believes the healthcare bill will be the final nail in the coffin of the U.S. economy and will just about guarantee that we will see hyperinflation by the year 2015.

The U.S. government last week reported a record monthly budget deficit for February 2010 of $220.9 billion. Total tax receipts for the month were only $107.5 billion compared to outlays of $328.4 billion. The total U.S. deficit for the first five months of fiscal year 2010 was $651.6 billion, with tax receipts of $800.5 billion and outlays of $1.45 trillion. The deficit was up 10.5% for the first five months of fiscal year 2010 over the same period in fiscal year 2009.

We are now at a point where if the U.S. government taxed Americans 100% of their income, the tax receipts generated would not be enough to balance the budget. Likewise, if the U.S. government cut 100% of its spending including defense, but kept paying Social Security, Medicare and Medicaid, we would still have a budget deficit. NIA believes it will be impossible for the U.S. to have a balanced budget ever again.

The U.S. national debt is now $12.67 trillion of which $8.061 trillion is public debt. Due to the Federal Reserve’s artificially low interest rates of 0% to 0.25%, interest payments on our national debt last month were only $16.9 billion, an interest rate of only 2.548% on our public debt. The reason for the spread between our 2.548% interest rate on the public debt and the federal funds rate of 0 to 0.25% is that a portion of our national debt is made up of long-term bonds at higher interest rates.

Our debt ceiling was recently raised to $14.3 trillion, which we are on track to reach in less than a year, sending our public debt up to about $10 trillion. If the Federal Reserve raises the federal funds rate up to just 2% during the next year, NIA believes the interest rate on our public debt could rise to 5% and our annual interest payments will likely rise to $500 million or 23% of projected 2010 tax receipts of $2.165 trillion.

The White House is not projecting for interest payments on the national debt to break the $500 million mark until fiscal year 2014. By then, even if we go by White House projections that the deficit will be cut to $828 billion in 2012, $727 billion in 2013 and $706 billion in 2014, in 2014 we will still be looking at a national debt of over $18.5 trillion with a public portion of around $13.14 trillion. We find it shocking that the White House is projecting an interest rate on our public debt in 2014 of only around 4%.

All of this means that the While House expects the Federal Reserve to leave interest rates at artificially low levels almost indefinitely. However, we know it will be impossible for them to do so without creating a huge outbreak of inflation in the prices of food, energy, clothing, and just about everything else Americans need to live and survive. In order to prevent hyperinflation, we need interest rates to be higher than the rate of inflation.

NIA believes the real rate of U.S. inflation to already be approximately 5%. If the Federal Reserve doesn’t raise the federal funds rate to above 5% in the short-term, in our opinion, an outbreak of double-digit inflation is inevitable. By 2014, it is possible the Federal Reserve will be forced to raise the federal funds rate up to above 10% and the public portion of our national debt could exceed $15 trillion. Therefore, in 2014 we could see the interest payments on our national debt reach $1.5 trillion, about triple what is currently being projected and 43% of the government’s projected tax receipts that year of $3.455 trillion.

Besides the cost of the healthcare bill and rising interest payments on our national debt, another major catalyst for hyperinflation will be social security payments, which adjust to the CPI-index. As the government’s CPI-index rises, so will the social security payments that it owes. This could cause a death-spiral in the U.S. dollar. Inflation is still the last thing on the minds of most Americans, but soon it will be their primary concern.

To receive NIA’s latest updates about inflation and the economy, sign-up for the free NIA newsletter at: http://inflation.us

About us:

The National Inflation Association is an organization that is dedicated to preparing Americans for hyperinflation. The NIA offers free membership at http://www.inflation.us and provides its members with articles about the economy and inflation, news stories, important charts not shown by the mainstream media; YouTube videos featuring Jim Rogers, Marc Faber, Ron Paul, Peter Schiff, and others; and profiles of gold, silver, and agriculture companies that we believe could prosper in an inflationary environment.

Contact: Gerard Adams, 1-888-99-NIA US (1888-996-4287), editor@inflation.us

SOURCE National Inflation Association

Market Commentary From Monty Guild

THE GLOBAL BANKING CRISIS CONTINUES…

STAGE 2: EUROPEAN SOVEREIGN DEBT UNDER ATTACK

Taken together, the Icelandic and Greek financial crises can be seen as the second stage of the larger global banking crisis. The first stage of the global banking crisis, which began in late 2007, was centered in the European and U.S. mortgage and mortgage derivative market. The second stage began with Iceland’s monetary and fiscal crisis in 2009 and continues with the current Greek crisis, and is centered in European sovereign debt.

The global crisis banking crisis is a multi-phase global economic crisis caused by years of over-borrowing followed by the current deleveraging. This deleveraging was, of course, set in place by all those who gambled with their own and other people’s money. As time passes, more and more of these gamblers will be unmasked and there will be more countries, companies, industries, and individuals who will lose face and capital in coming months and years. We anticipate that these problems will continue as various sectors delever over the next six to eight years.

Many believe that the other European nations will act to bail out Greece, and then perhaps Spain or other over-levered nations in Europe who experience debt problems. We disagree. In our opinion, the International Monetary Fund (IMF) is the lender who will bail out the damaged European nations. In our opinion, it is too hard for European nations to go to their taxpayers and tell them that they are directly or indirectly guaranteeing the debt of a foreign country. Read the rest of this entry »

Latest From Jim Sinclair on the Federal Reserve Gold Certificate Ratio

Jim,

Armstrong sees the Gold bull market lasting until roughly 2016 (17.2 years starting in 1999). Is it at this point that you see the USDX bottoming at .5200?

Is it at that point when you see the Federal Reserve Gold Certificate put in place? According to cyclical analysis it would come at the low point business wise of the 17.2 cycle.

How long do you think this world monetary system will take to be implemented?

I guess once again the US will lead the process.

Do you think China (or India) will take a major role in it?

Will it be done under the IMF umbrella?

After the Federal Reserve Gold Certificate is in place, do you believe that the world´s economy can enjoy some period of stability (with the exception of geopolitical considerations)?

Best regards,

CIGA Christopher

Christopher,

I see the USDX bottoming between .4600 and .5200, yes. I have learned not to argue with Armstrong on cycle timing. Gold should have a temporary high point between January 14th and June 25th, 2011.

Implementation is not a process, it is a surprise.

The US will not necessarily lead the process. By then the IMF will be the Western World Central Bank, if not in name, certainly in function.

China and India will play a major role by demand via back financial channels.

It will likely be done under the IMF umbrella as part of a Super Sovereign Currency.

After the Federal Reserve Gold Certificate is in place the world’s economy should be able to enjoy a period of stability for a considerable amount of time, but with a total rearrangement of positions of national economic powers moving towards Asia and do not forget Jakaya Kikwete and the common market of sub Sahara African countries of merit and leadership. They are there.

Regards,

Jim

Golden Comet Now Seen By The World: $1650 Target In Sight

As I write to you this evening, the very real prospect of hyper-inflation, a catastrophic currency event, is staring down the vast world of US dollar-denominated paper promissory notes. Gold is behaving like a bright comet in the sky, grabbing the attention of the keen observer and giving them an edge over others who are too distracted to look up.

The confidence model is rapidly crumbling, after many years of neglect; the US dollar bubble is finally bursting in an awesome way. If there were genuine integrity, then surely such a model would do; but the lack of sufficient moral fortitude in the hearts of men, makes it virtually impossible to have a confidence based economy for very long; because the confidence is merely an illusion and the model can only be sustained as long as the illusion persists.

On the daily chart, we see panic buying (and short covering) driving the price of gold to well above $1200 dollars. Major central banks, such as the Indian central bank, have become large-scale buyers of Gold.

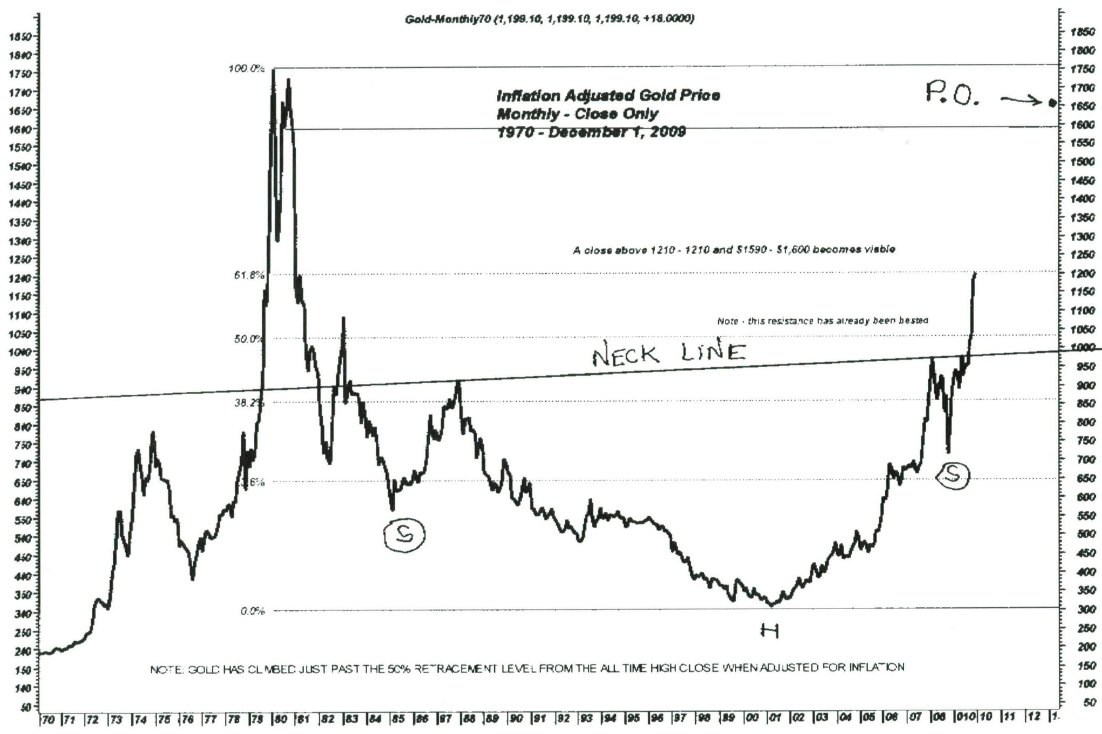

It looks like my original medium-term target of $1379 is going to be upon us relatively soon. Our next target may soon be followed by a touch of the inflation-adjusted high of $1650, followed by a period of consolidation.

The picture becomes clearer if we look at the inflation-adjusted monthly chart, showing the gold price action clear back to 1970. Considering official inflation statistics, we can see that gold has yet to move past its previous high, despite a vast expansion in monetary aggregates, which has occurred during the past several decades.

Nobody can say for sure what will happen with the short-term fluctuations. But longer-term it is quite clear that the price of gold will move into the $5,000 range, as the reality of the need for hard assets sets in. It doesn’t take but a few billion dollars worth of gold purchases to create a significant increase in the gold price. Given all of the trillions of dollars already in circulation and the trillions planned for bailouts; the target of $5,000 will likely turn out to be a conservative target, once the dust has all cleared.

A Golden Comet in the Sky

A golden comet now lights up the sky; an omen of what is in store for our future. Gold is up just over 50% during the last 1-year period. Given the buying strength we are seeing lately, especially from central banks, we will likely see gold in the $1600 range quite soon.

Of course, there will be road-bumps along the way; but the general course will take us to $1650 and then into the $3000-5000 range. Where Gold goes beyond there depends on the monitary policies of the United States and what kind of thinking takes hold as all of this inflation begins to hit hard where it hurts.

The beautiful thing about gold, is the fact that it gives us all a clear omen, which allows the wise and observant among us, a chance to prepare for difficult times ahead. This golden comet will become ever more brilliant with the passage of time. Perhaps most of us will soon realize what is occurring and what they must do to deal with the situation. This situation isn’t going to go away on it’s own and nobody is going to solve the problems it creates for us in our stead.

Gold Swiss Stair Formation Following Wedge Breakout

Bill Gross: Assets Are $15 Trillion Overvalued And Fed Will Keep Rates At 0% Forever To Keep The Fantasy Alive

Henry Blodget | BusinessInsider.com

PIMCO’s Bill Gross with a great monthly letter. Here are the key points:

- Over the past 30 years, paper asset prices rose 2X as much as they should have based on economic fundamentals

- This was the result of leverage

- The asset price rise in turn pumped up the economy’s fundamentals (Soros’s reflexivity)

- The government wants to restore the “old normal” (2007) not the “new normal” (slower growth as asset prices return to trend)

- Therefore… The Fed will keep rates at 0% for at least 18 months into sustained 4% growth

- Next year, when the inventory restocking effect wears off, 4% will be tough

Bill Gross:

[I]n a New Normal economy (1) almost all assets appear to be overvalued on a long-term basis, and, therefore, (2) policymakers need to maintain artificially low interest rates and supportive easing measures in order to keep economies on the “right side of the grass.”

Let me start out by summarizing a long-standing PIMCO thesis: The U.S. and most other G-7 economies have been significantly and artificially influenced by asset price appreciation for decades. Stock and home prices went up – then consumers liquefied and spent the capital gains either by borrowing against them or selling outright. Growth, in other words, was influenced on the upside by leverage, securitization, and the belief that wealth creation was a function of asset appreciation as opposed to the production of goods and services…

My point: Asset prices are embedded not only in our psyche, but the actual growth rate of our economy. If they don’t go up – economies don’t do well, and when they go down, the economy can be horrid.

To some this might seem like a chicken and egg conundrum because they naturally move together… if long term profits match nominal GDP growth then theoretically stock prices should too.

Not so. What has happened is that our “paper asset” economy has driven not only stock prices, but all asset prices higher than the economic growth required to justify them…

[L]et me introduce Chart 2 a PIMCO long-term (half-century) chart comparing the annual percentage growth rate of a much broader category of assets than stocks alone relative to nominal GDP. Let’s not just make this a stock market roast, let’s extend it to bonds, commercial real estate, and anything that has a price tag on it to see if those price stickers are justified by historical growth in the economy.

Gold Moves into Uncharted Territory

The price of gold has cleared the former all-time high, reaching into the $1040 (USD) range for the first time in the history of the yellow metal. The chart below illustrates how gold formed and broke through a bullish inverted head & shoulders formation, broke through the top of a consolidation wedge, and broke through a wedge in the MACD indicator.

With an RSI reading of 70, gold is one hot commodity. This should start ringing some alarm bells at major money centers around the world. It is becoming ever-more apparent, that we are experiencing a serious rout of inflation which could very well turn into a devastating wave of hyper-inflation in due time.

Thoughts on the Gold Chart and Economics

- Bounded by the gray trend lines: an Expanding Corrective Wave which was broken to the up-side, the upper bound of this formation was then re-tested confirming the breakout.

- Bounded by the red trend lines: a Wedge formation which was broken to the upside last week.

- Denoted by the purple trend line: an Inverse Head & Shoulders formation with the current price hovering close to the neck-line.

- Denoted by the red trend lines in the MACD indicator (below): a Wedge formation which was broken to the up-side.

- Last week gold had a historic close. In fact it was the highest weekly close ever for gold; leaving it above the psychologically significant $1,000 mark after a weekly close for the first time in history.

As of September 25, gold has broken through two long-term formations and sits at the neckline of an inverse head & shoulders formation.

Given that gold closed the week at the neckline of such a long-term Head & Shoulders formation, after having shown such resilience over the past few weeks, it is time we prepare ourselves for a significant move, further into unknown territory. The chart above indicates that gold is acting like a coiled spring, ready for the slightest trigger, to send it into launch mode; bringing the price into the $1200-1300 USD range.

When I look at this chart, I am reminded of the 2002-2003 period, when gold was hovering around the $375 range in a large wedge formation. At the time everyone was thinking, “this must be it for gold, it’s already had such a run from $250, the bull run surely must be over by now.”

I remember seeing the wedges, similar to the current chart, though less volatile than the current price fluctuations. I remember seeing a good-sized wedge in the MACD which had broken to the upside. In fact, it was at this time that Jim Sinclair, the CEO of Tanzanian Royalty Exploration and the author of Jim Sinclair’s Mine Set had a contest for gold community members to draw the relevant trend lines on an Investors Business Daily gold chart that he provided. The prize for this contest was a one ounce gold coin.

Well, I took Jim up on his offer and drew formations similar to those on the attached chart. Including a MACD breakout precisely like the one on the current chart. I made the chart simple yet elegant and intuitive and fortunately for me; out of all of the hundreds of charts sent in to his fax, he chose mine as the winner. What a great feeling that was and what an appreciation I gained for the power that each of us has to understand what is going on in the economic world with elegant simplicity not endless complexity.

It was even more rewarding to see gold advance to $450 by late 2004 and then $700 by 2006. What you have to realize, when you are studying these charts, is the fact that the underlying forces which propel gold skyward have not changed. The governments and central banks of the world continue to employ their disastrously flawed Keynesian economic models which create welfare, warfare and ultimately massive inflation.

Politicians love having all of the “free” money, hot off the printing press, to buy votes, line the pockets of their associates and bail out their friends. That is why these leftist notions of a nanny state taking care of us from cradle to grave, often embraced by Republicans and Democrats alike, is not going to solve the problems it was intended to solve.

This is because everything has a cost, yes even the nanny state, corporate welfare and the like. As the price of the yellow metal rises the buying power of the savings of billions of individuals decreases; so they are in effect robbed in broad daylight by the Keynesian inflationary policies. Is it any wonder that the standard of living continues to decline all over the western world.

“We can’t solve problems by using the same kind of thinking we used when we created them.” –Einstein

One of these days, it may dawn upon people, en mass; that in general the government doesn’t solve problems, it only creates problems. So the only way to truly solve problems is by strictly limiting the role of government to that of a referee and letting the free market bring about the solutions we need.

Had the free market been allowed to act upon zombie banks years ago, when the problems first arose; these banks would have never become “too big to fail.” Had the free markets been allowed to act, unhindered, in the health care field, we would have more choices and less people unable to get the help they need.

Unfortunately, with the public school educated populace; the first place they turn whenever their is a problem is the government. So we have the Hegelian dialectic, “(problem) oh goodness, what a dreadful problem! — (reaction) what are they going to do about it? — (solution) the policies that were originally sought, but did not find the political support are now widely supported and then implemented without much opposition.”

It really saddens me to see my countrymen repeating this cycle over and over again, unaware and uncaring of the fact that it makes their lives much more difficult and constrained. I often wonder when it will become apparent to them that all of this nonsense isn’t working. Will it be when gold is at 3,000? 5,000? 10,000?

I can’t say for sure when decisive action will be taken; but if history is any indicator, inevitably there will come a point at which the pull of the massively centralized state on people’s lives distorts the culture of these people to such an extent that they decide they’ve had enough of it. This would be the point where they realize that it costs so much more to live in a massive welfare state than the benefits that are derived from it and the productive individuals either demand real change, or they pull up anchor and head for some place which will suit their needs.

Ghost Economy: The World Sits Idle

During the boom years of globalization and credit expansion, a tremendous amount of over-capacity was created. Now that consumers are tapped out and the bills are coming due, we see economic phenomena such as: idle shipping vessels, idle dock cranes and shipyards running out of orders for new ships to build.

These are the kinds of outcomes you see when people become driven by the irrational forces of the current international fiat money system. Supply and demand are not as effective when you have government and monetary authorities toying with foreign exchange rates and creating vast sums of fiat; this wreaks havoc on markets and causes the severe imbalances we have been seeing as of late.

One of the most telling signs, of how crippled world economy has become lately, is a vast fleet of idle cargo ships off the coast of Singapore. With trade dropping off around the world, the price to charter these ships is now a tiny fraction of what it was in better times; many ships cost 1/10 of what they once did.

Unless we replace our monetary system with sound hard-asset-based money, it is likely that we will continue to see these kinds of severe imbalances for many generations to come.

Revealed: The ghost fleet of the recession

The biggest and most secretive gathering of ships in maritime history lies at anchor east of Singapore. Never before photographed, it is bigger than the U.S. and British navies combined but has no crew, no cargo and no destination – and is why your Christmas stocking may be on the light side this year.

The tropical waters that lap the jungle shores of southern Malaysia could not be described as a paradisical shimmering turquoise. They are more of a dark, soupy green. They also carry a suspicious smell. Not that this is of any concern to the lone Indian face that has just peeped anxiously down at me from the rusting deck of a towering container ship; he is more disturbed by the fact that I may be a pirate, which, right now, on top of everything else, is the last thing he needs.

His appearance, in a peaked cap and uniform, seems rather odd; an o fficer without a crew. But there is something slightly odder about the vast distance between my jolly boat and his lofty position, which I can’t immediately put my finger on.

Then I have it – his 750ft-long merchant vessel is standing absurdly high in the water. The low waves don’t even bother the lowest mark on its Plimsoll line. It’s the same with all the ships parked here, and there are a lot of them. Close to 500. An armada of freighters with no cargo, no crew, and without a destination between them.My ramshackle wooden fishing boat has floated perilously close to this giant sheet of steel. But the face is clearly more scared of me than I am of him. He shoos me away and scurries back into the vastness of his ship. His footsteps leave an echo behind them.

Navigating a precarious course around the hull of this Panama-registered hulk, I reach its bow and notice something else extraordinary. It is tied side by side to a container ship of almost the same size. The mighty sister ship sits empty, high in the water again, with apparently only the sailor and a few lengths of rope for company.

Nearby, as we meander in searing midday heat and dripping humidity between the hulls of the silent armada, a young European offi cer peers at us from the bridge of an oil tanker owned by the world’s biggest container shipping line, Maersk. We circle and ask to go on board, but are waved away by two Indian crewmen who appear to be the only other people on the ship.

‘They are telling us to go away,’ the boat driver explains. ‘No one is supposed to be here. They are very frightened of pirates.’Here, on a sleepy stretch of shoreline at the far end of Asia, is surely the biggest and most secretive gathering of ships in maritime history. Their numbers are equivalent to the entire British and American navies combined; their tonnage is far greater. Container ships, bulk carriers, oil tankers – all should be steaming fully laden between China, Britain, Europe and the US, stocking camera shops, PC Worlds and Argos depots ahead of the retail pandemonium of 2009. But their water has been stolen.

They are a powerful and tangible representation of the hurricanes that have been wrought by the global economic crisis; an iron curtain drawn along the coastline of the southern edge of Malaysia’s rural Johor state, 50 miles east of Singapore harbour.

It is so far off the beaten track that nobody ever really comes close, which is why these ships are here. The world’s ship owners and government economists would prefer you not to see this symbol of the depths of the plague still crippling the world’s economies.

So they have been quietly retired to this equatorial backwater, to be maintained only by a handful of bored sailors. The skeleton crews are left alone to fend off the ever-present threats of piracy and collisions in the congested waters as the hulls gather rust and seaweed at what should be their busiest time of year.

Local fisherman Ah Wat, 42, who for more than 20 years has made a living fishing for prawns from his home in Sungai Rengit, says: ‘Before, there was nothing out there – just sea. Then the big ships just suddenly came one day, and every day there are more of them.

‘Some of them stay for a few weeks and then go away. But most of them just stay. You used to look Christmas from here straight over to Indonesia and see nothing but a few passing boats. Now you can no longer see the horizon.’

The size of the idle fleet becomes more palpable when the ships’ lights are switched on after sunset. From the small fishing villages that dot the coastline, a seemingly endless blaze of light stretches from one end of the horizon to another. Standing in the darkness among the palm trees and bamboo huts, as calls to prayer ring out from mosques further inland, is a surreal and strangely disorientating experience. It makes you feel as if you are adrift on a dark sea, staring at a city of light.

Ah Wat says: ‘We don’t understand why they are here. There are so many ships but no one seems to be on board. When we sail past them in our fishing boats we never see anyone. They are like real ghost ships and some people are scared of them. They believe they may bring a curse with them and that there may be bad spirits on the ships.’

Gold is Poised for Liftoff

It looks the yellow metal is preparing for another increase. Tonight it is moving above the key $1000 level to $1008 USD. Based upon the inverted Head & Shoulders formation on the medium-term chart, the target on this move is approximately $1379. If this indeed occurs, it means a tremendous selloff in the US Dollar; because gold almost always acts in inverse of the US dollar.

The extent to which the dollar falls relative to the other currencies depends on how much gold increases relative to those currencies. As has been predicted for years, we are moving from a confidence based economy into a hard asset based economy.

Over then coming weeks, I expect we will see some shocking dollar corrections in the currency markets; which will begin to wreak havoc over the daily lives of billions of people. We are likely to see civil unrest, rapid increases in prices for everyday items and shortages.

Elliott Wave Formation in Gold as it Reacts off of its all-time high at $1037.

Gold broke out of the recent consolidation wedge, confirming some recent bullish activity.