Martin Armstrong: Staring Into the Abyss

Martin Armstrong’s history has shown his mastery at truly understanding the laws of economics. He has predicted many of the pivotal economic events over the past few decades and has developed a highly sophisticated PI-cycle forecasting system, capable of cutting through the bullshit; becoming more aware of what is really going on in the world of economics.

On July 31, 2010 Armstrong published a newsletter issue titled Staring Into the Abyss in which he detailed his latest predictions for our future. I have transcribed this newsletter, from its type-written form, so it will be searchable and more useful to the community.

Staring into the Abyss

by Martin A. Armstrong

When all is said and done, no matter how we spin the story, we are in the final stages of the collapse of Western Society as we know it. By that I do not mean the sky will fall and people will be running through the streets naked fighting over 2 week old bread. That did not even happen with the fall of Rome, nor with Communism in China and Russia. It is possible that our political ruling class become so desperate that they take the tyranny path to extort every dime from the people hoping to hold on to fleeting moments of past glories. When it is all said and done, we will ask how was this citadel of the earthly powers of man fallen, and laying motionless and prostrate on the ground before all the great empires that have expired before it. The answer will be the same. Debt and fiscal mismanagement. Our greatest problem has been our arrogance and presumption that we have conquered history and the laws of practical economics do not apply.

When empires die, the clash between private and public assets swings into hyperactive mode. Those who see the Dow crumble and fall to 1400 because that is what happened in 1929, fail to ever understand that such an event took place because of deflation that was created by the fact that the dollar rose to extreme levels when everyone else was defaulting in 1931. This is why Roosevelt confiscated gold and devalued the dollar by raising gold from $20 to $35. Money was still something tangible. Today, we are looking at a massive sovereign debt default on a worldwide level.

Under a situation from the European view in 1931, the only thing to survive was tangible assets. That is not only gold, but shares in corporations with tangible value. velocity is always the key for as it declines due to people hoarding money you get deflation. When people are afraid the money will become worthless (paper or debased coinage) they spend it faster before it depreciates and that creates hyperinflation at the other extreme. It all depends on where the confidence resides – with government or within the private sector. We are headed into the later.

I have been working at full speed to get this book complete. I have passed the 300 page mark and I am deeply in debt to those assisting me from outside to get me the reference material I need to ensure this is more than just an opinion, but also authoritative.

Adam Smith in his Wealth of Nations wrote in his final volume about Public Debt and what he asked was why people had ever considered lending money to government was safe or that their debt was somehow quality. I have been working on this issue in great detail. Smith stated that never had any government ever paid off its debt and that was in 1776. He was correct. I am assembling all the defaults that are a subject that no one seems to want to talk about.

Yet, there are stark and monumental conclusions that emerge from such a long list of defaults. Society does not end as the doomsday crowd portray. This seems to be just their desire or opinion. Many seem to wish disaster upon the world for they feel cheated and did not become rich with the crowd. But those sorts of claims are truly the exception. The fall of Rome ended in disaster as people fled cities and the population of Rome itself fell from 1 million to just 30,000. That was what the Romans called suburbium and why we still today call moving out of the city to the suburbs. The flight took place because of the collapse of the Rule of Law and unprecedented taxation that set in motion a migration that eventually lead to feudalism.

Today, we have no place to go. We have run out of room. It is possible that government becomes so hostile that they will call the troops out against our own people. But that does not always succeed. The troops in China and Russia hesitated to slaughter the people. In the famous Nika Revolt in Constantinople of January 532 (“Nika” means conquer), the Emperor Justinian feared for his life because the troops would not defend him. He was lucky that there were foreign mercinaries nearby and they came to his aid and slaughtered about 30,000 citizens who had gathered in the Hippodrome (local stadium where chariot races took place).

In most cases there is no civil war. Typically, the government collapses. In ancient times they may assasinate the head of state, but that tended to be more in the line of monarchs who ruled for life. The Puritans cut off the head of Charles I in England, but that was just when the slave becomes king, he becomes even more ruthless than the person he overthrows.

As pictured above, Oliver Cromwell put his own portrait on the coinage as if he was king. Napoleon crowned himself Emperor, and Stalin murdered 20 million people after claiming injustice of the monarch Nicholas Romanav justified murdering him and his whole family in July 1918. Clearly, sometimes revolution produces far worse alternatives.

Yet the unifying trend that ties all of these events together is fiscal mismanagement and a debt crisis. This is far more serious than a mere 1929 correction. When governments collapse, it can get very, very nasty. This is when tangible items of value, gold, antiques, art, and movable objects have a basic barter worth. Land typically declines to its basic value non-leveraged cash value. Even during the Great Depression, land that was valued at $1.20 in the mid 1800’s per acre fell to 30 cents. This is caused by the LACK of any credit to allow borrowing that is leverage in the real estate market. A 30 year mortgage brings forward 30 years of future income today. It is not money yet earned.

Even when we look at Spain and France, one must ask why these two European nations have failed to climb to the level of being the Financial Capitol of Europe? Both nations adopted the Economic Conquest Model. In plain words, this was the Roman model of plunder. They sought to advance by conquest gathering all the money they could from foreign lands. They failed to look at their people as any sort of worthwhile resource. They did not seek to develop industry. They did to some extent support mercantilism. However, in the case of Spain, they were so busy just extorting gold and silver from America, in fact they spent it long before the ships ever arrived. They did not use the money to develop the economy. They imported the menial labor from France, and sent the money on fatal conquest attempts like the conquest of Netherlands and the Spanish Armada against England.

Charles I (1516-1556) of Spain was also the Holy Roman Emperor Charles V (1519-1556). He exploited Spain to further his glorified interests as Emperor and sent the nation into bankruptcy. Spain defaulted on its public debt in 1557, 1570 in Antwerp, 1575, 1596, 1607, 1647, 1662, 1695 and 1697 just for starters.

Both France and Spain were serial defaulters. Why anyone would lend them money cannot be rationally explained. This is why after wiping out both the German and Italian bankers, the Financial Capitol moved to Amsterdam. When William of Orange (Dutch) king took over England in 1689, he brought Dutch ideas with him and the Financial Capitol moved to London.

During the panic of 1896 when the US was bankrupt, J. P. Morgan convinced his British banking friends to lend to the US Treasury. After World War I, London gave up the Financial Capitol to New York. In 2000, New York had 60% of the world IPO market. Because of the outrageous decline in the Rule of Law in the United States, that has fallen to less than 5% and now foreign companies no longer feel it is prestigious to be listed in New York. The US is losing that status rapidly and the impending DEBT CRISIS will be the final straw.

We have a front row seat at what will prove to be the most economically interesting times in the history of man. Will we turn to internal war or international war over a debt crisis our public officials refuse to disclose at all? Or can we save society and preserve our culture for our children? These are the most important questions that need to be answered authoritatively.

Meanwhile, the markets are performing according to script. The one thing about the market and free market theory, which the socialists hate, is that the markets are never wrong. It is our job to interpret what they are trying to tell us for they collectively see all truth and cut through all the bullshit. The socialists hate this theory because they want to manipulate society and the finances to achieve their Marxist goals that are unsupportable.

The mere problem is the markets are making a critical staging decision at this time. They are sorting out the whole idea of a double dip, how far, and how will this effect the future in terms of months, years, decades, and centuries. The markets are deciding the extent of a fake-out-move that means there is typically a move in the opposite direction from the true direction the market will adopt.

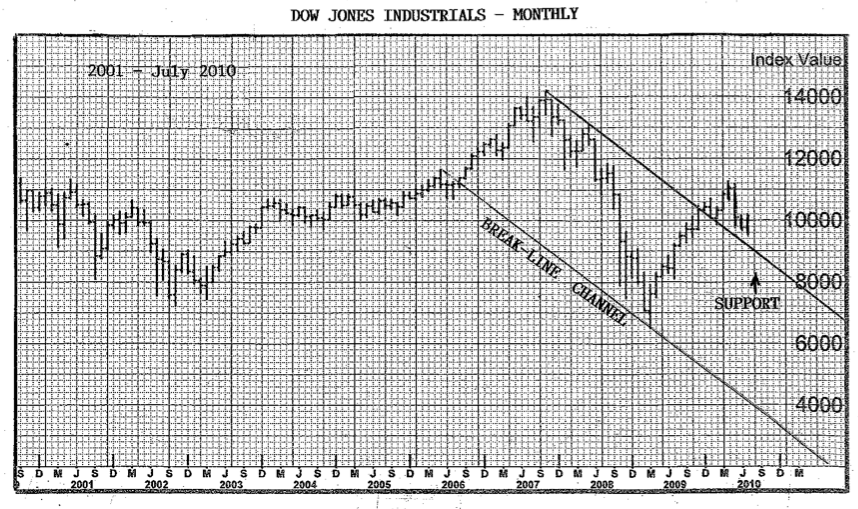

In other words, from the 2000 high, the Dow Jones Industrials moved down into 2002 for the bottom of the Economic Confidence Model. It elected the first three (3) monthly sell signals generated from each event but tested the fourth at 7181.47 in October 2002 yet the lowest monthly closing was 7591.93 in September. The January 2000 high at 11908.5 Therefore, the fourth reversal held and that signaled the decline was over. To create a downtrend, the first four reversals must give way or else it is just a reaction.

So far, the intraday low was made in March 2009 at 6440.08. The lowest monthly closing was in February 2009 at 7062.93. That same number today from the 2007 high sits at 6935.

On the upside, the highest closing came in April on a monthly basis at 1108.61. The actual bullish reversal stands at the 11025 level. We did reach intraday 11308.95 but that has been unsustainable. Only a monthly closing below 9640 will suggest a retest of the 2009 low. The July low has been 9596 so far.

As we look into August, there still appears to be that this upcoming month will present the decision point. The main vital support during August lies at 9295 with the major support at the 8050 level.

As we look into the abyss between this August target and June of 2011, the markets are going to tell us the future. Those who are the perpetual bulls who presume life will go on and society will never falter, are already touting that gold will decline just as soon as people get back to normal. They do not address the fact that their opinion is merely a triumph of hope over cold hard experience. Never has such a debt crisis of this magnitude been able to hide under the covers forever.

This is not the end of the world. It is merely the end of fiscal mismanagement. This is not even the clash between paper currencies and gold as many wish to point out. Hard money is not the answer either. The issue is simply about spending more than we will ever earn and the constant pushing off to tomorrow what we cannot pay today. This is when the music stops. It has never been avoided even once in history out of countless times. Do you think that Russia or China honor the debts owed to capitalists after their Revolutions? Did Iran honor its debt after it chased the Shah out? Nobody has ever honored the debts and all go broke just has taken place without a single exception. Japan who tried to claim it did not default, did so in 1942. So did Britain in 1342 and the USA never honored its debts of the Continental Congress despite the Constitution stating it would do so.

So we can talk opinion and spin the people with more bullshit hoping they will run around in circles and overlook what is going on, but the pinata has suffered several deadly blows and it will soon fall and the hidden contents will be exposed for all to see. When the first debt auction is not fully bid, look-out. The pinata is about to fall.

The week of June 14th produced the highest weekly closing in the cash Dow. We fell to a new low for the week of June. Looking into August, we have a couple of weeks that will be interesting. August 2nd and the last week August 30th-Sept 3rd. A weekly closing below 9700 would signal further weakness. So we must watch this area on a weekly closing basis and what is produced the last week of August. If we see a high, then there may be a sharp drop into October, rebound into January 2011. However, an August low may lead to a rally in May with a Panic in June 2011, but even that looks a 2 month panic at best.

Leave a Reply