Why the Federal Income-Tax is Unnecessary and Immoral

One of the firmest rooted myths in today’s American society, is this notion of an income tax. It is one of those consensus reality illusions which has wormed its way into our culture in the 20th century. A thorough investigation into this matter, shows that there is much controversy as to whether or not this tax is even valid, when applied to most Americans.

It is often thought that the 16th amendment gives congress this power to tax labor. However, in 1916, the Supreme Court of the United States ruled “the Sixteenth Amendment does not purport to confer power to levy income taxes” in Brushaber vs. Union Pacific Railroad.

It is unfortunate that the majority of the population still does not understand the law, or the reason why the Constitution forbids direct un-apportioned taxes. If this understanding of the law were more wide-spread, we would see the end of many of these organizations which take of the fruits of our labors.

The graduated income tax and the institutions it supports are deeply immoral; it undermines the inalienable rights of the individual and gives the Federal Government virtually unlimited power to take our property and control our lives.

Unnecessary and Immoral

By Jake Towne | Campaign For Liberty

“In a Time of Universal Deceit, Telling the Truth is a Revolutionary Act.”

– George Orwell, author of 1984Summary: The federal income tax is an unnecessary and immoral tax. I am in favor of abolishing the federal income tax and eventually the entire IRS. YOUR income from YOUR labor belongs to you and no one else, especially the government, has the right to steal it from you. Most Americans are unaware that while the government collects $1,200 billion in federal income taxes and collects roughly $3,000 billion in total taxes, the fact is that “only” $67 billion is necessary to run the executive, legislative, and judicial branches, which includes the FBI and federal court system. (1) (2) (3) When one compares this amount to the Banker Bailout of October 2008 for $800 billion and the Obama Stimulus Plan for $1,100 billion with interest, one wonders why not bailout the taxpayer in a plunging economy instead?

Although a removal of this tax will be strongly opposed, likely not even addressed, by my Republican and Democrat opponents, I am extremely confident that this is the best step for each individual and our country as a whole to achieve prosperity since the tax’s only purposes are to redistribute wealth and steal the fruit of one’s labor. The elimination of this tax will be paid for by ending the costly overseas military empire of 761 bases in 147 countries which includes 54,974 soldiers based in Germany, and 34,039 soldiers based in Japan, although WWII ended 64 years ago. (4)

Since eliminating the tax may not be politically possible while I am in office, I also pledge to aggressively fight to abrade the strength and breadth of this tax by introducing a series of bills that legislate changes such as no income tax withholding from paychecks, no taxes on tips, raising the standard deduction, removing taxes on capital gains and interest, and many more. I am open to supporting other transition plans and ideas, but all must undeniably reduce the tax burden, and not be “revenue-neutral.”

I recognize that most people have been engrained with the idea that we must have an IRS income tax, that everyone must “pay their fair share” to the country. Although I will grant that an absence of taxes is impossible, nothing could be further from the truth than to claim the federal income tax is necessary. Therefore, here is the truth with sources to support my reasoning:

1)The federal income tax was originally a Marxist idea. In 1848, Karl Marx wrote the 10 Planks of a Communist State in his Communist Manifesto. The second plank, right after the abolition of private property was “a heavy progressive or graduated income tax.” (5) In 1909, this Marxist idea was politically accepted by Americans as retribution against the “evil capitalists” who had caused the Panic of 1907, although fraudulent money and credit expansions by the bankers was the real root cause. 100 years later, both political parties still scapegoat all those in the financial industry as “evil doers.” (6) (7) By claiming an ever-increasing amount of your income, the State literally owns your labor. The progressive income tax strongly discourages the creation of new innovations, goods and services, as well as depleting and discouraging citizens to obtain more income. (photo)

2)The federal income tax has grown far beyond its original scope. The income tax was first placed into circulation as a 1-7% tax on only the very richest Americans. The first IRS income tax form had all those earning less than $20,000 paying NOTHING. (8) This may sound insignificant but, per the Minneapolis FED, this was the equivalent of $430,707 in 2009. (9) This top tax bracket grew to an onerous 92% in the 1950s. While the rate for the richest has receded, for the middle class this tax has grown 500% to 1000% from this time period. (10) Today, the top 1% of all wage-earners still pay over 40% of the total income tax collected. (11)

However, this certainly does not mean that the average American is not taxed heavily. An American making a salary of $50,000 will still pay around 15% in federal income tax without factoring in tax on interest and capital gains. This is in addition to the 15.3% payroll flat tax from Social Security and Medicare, the 3.07% Pennsylvania state income tax, any local, estate, vehicle, sales or property taxes, and the most vicious hidden tax of them all, the FED’s inflation tax, which has been running amok at 5-10% annually since 2002. (12) (13)

3)The premise behind collecting the federal income tax is a complete farce. The IRS claims the tax is voluntary, whereas any sane American realizes that she or he will go to jail if the tax is not paid. The Treasury calls it “our voluntary tax system.” (14) The IRS claims it pursues “enforcement programs to promote voluntary compliance” and establishes “strategies to maximize voluntary tax law compliance by emphasizing customer satisfaction.” (14) This is evident from not only the legal code, but even from the latest 1040 instructions to the taxpayer! (15A) (15B) (16)

IRS Commissioner Douglas Shulman writes that the American taxpayer willingly pays income tax “of their own free will” but laments “unfortunately, there will always be some that cheat their fellow citizens by avoiding the payment of their fair share of taxes.” Shulman then infers that IRS enforcement will be “prompt” and “strong” (read: ‘swift’ and ‘merciless’) for this voluntary tax. (17)

4)The federal income tax is of dubious constitutionality and the Founding Fathers sought to prevent it. The 16th “Income Tax” Amendment of 1913 may never have been officially ratified, and even if it was, in 1916 the Supreme Court ruled “the Sixteenth Amendment does not purport to confer power to levy income taxes” in Brushaber vs. Union Pacific Railroad. (18) (19) (20) (21) However, I do concede the point that Congress has successfully used the amendment as the basis of its powers to tax incomes.

It is important to realize that the Congress can stop the income tax without first revoking the 16th Amendment. After all, the 16th Amendment did not really create a NEW tax; all it did was allow for DIRECT taxation of the citizens. Before the 16th, federal taxes were apportioned; that is, each state paid their “dues” to the federal government based on population. Washington, D.C. never sent a tax bill to each individual citizen. The 16th changed all this, and it is crucial to understand that our Founders did not intend for this to happen because its omission was purposefully done in the original Constitution.

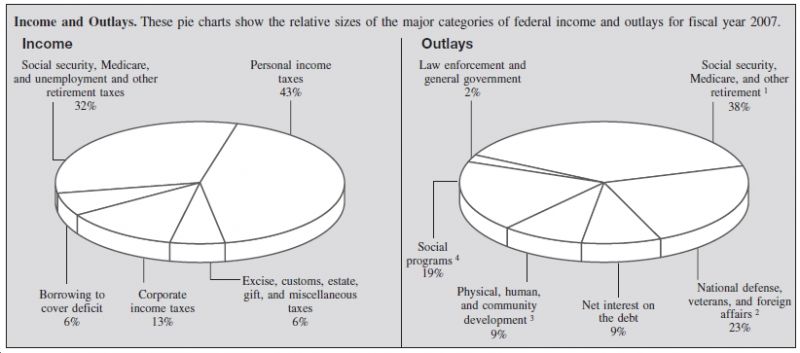

5)The income tax is mostly used for War-Making, the Welfare State, and the National Debt – not general government and law enforcement! The income tax amounted to $1.2 Trillion for 2008. (2) Outlays were for $2.9 Trillion plus the $0.8 Trillion October bailout. (1) We spent just $0.067 Trillion for general government and law enforcement! (3) Out of every tax dollar, the IRS estimates we spend about a quarter on defense, a dime on the national debt, two pennies on general government & law enforcement and the remainder on Social Security (a giant Ponzi scheme) and other welfare and social programs. (22) (23) (24)

Pie Charts Detailing Income/Spending of the US Government

6)The $1.2 Trillion federal income tax is unnecessary. Cutting our overseas military empire spending of $1 Trillion per year would justify its elimination. (25) Instead of bailing out the banks for $0.8 Trillion in October and $1.1 Trillion of the Obama stimulus plan, we could have bailed out the increasingly unemployed taxpayer for the 2008 and 2009 tax bills as I argued in January 2009. (26)

7)America did quite well for one hundred and forty (140) years without an income tax, from 1776-1913.

8)Since we do not have a sound currency anchored to anything, and the fractional reserve system has broken down, this makes the income tax even more unnecessary. As Irelated earlier, our dollar-based monetary system has been reduced to simple paper ticket printing or electrons in bank accounts. (27) It is no secret that we simply could just print up even more tickets each year to pay for government expenses instead of resorting to both the pretense and bureaucratic waste of having the IRS plunder the population. Although foreign Treasury bond holders would be horrified, at least the drop in purchasing power would be publicly visible and more honest to everyone, especially savers and those on fixed incomes.

9)Today’s Establishment use the federal income tax solely as an instrument to drive and force social and economic change. Let’s not bother with the more infamous loopholes, let’s look at the much-lauded mortgage tax credits. What were the effects? One, while beneficial for those with mortgages, the government added fuel to the FED-created housing boom by subsidizing more people to obtain mortgages. Two, over the long run, this increased demand increases the housing prices, removing some of the benefit in the tax break. Three, those without mortgages were, in effect, penalized. The same logic can be applied to other deductions, whether education credits, charitable donations, or even child credits or orphan drug research. (28) Government exists to protect liberty, not to redistribute wealth, grant special privileges, or influence the lives of individuals and their actions. (photo)

10) The federal income tax code is time-consuming, confusing and baffling for many Americans. No wonder the code itself now consists of 3.4 million words and if printed would fill 7,500 pages. (15B) The code and regulations together were 66,498 pages long in 2006. (29) The taxpayer’s 1040 instructions are 161 pages long.(17) Americans spent 6.4 Billion hours filing their taxes in 2006. (29)

11) America’s “Tax Army” employs more people (1.2 million) than we have armed forces stationed in the United States (0.9 million). (14) (4) Collecting taxes is a completely non-value added task, adding nothing to our economy. Some of our brightest minds — lawyers, accountants, and computer experts – pound away at keyboards trying to figure out either how to plunder more money from others or find loops in the tax code to “save costs” for their clients. The total cost of collecting taxes is estimated at $63 billion, ironically just $4 Billion short of funding general government and law enforcement! (30) (3) The IRS employs 91,000 and will spend $11.6 Billion in 2009 collecting taxes. (31) (32)

List of Sources

(1) White House. FY 2009 Budget. p. 35/342. Approx. $3,000 billion in 2008 outlays. http://www.whitehouse.gov/omb/budget/fy2009/pdf/hist.pdf

(2)Ibid. p. 26/342. Approx. $1,200 billion in federal income taxes collected in 2008.

(3) Ibid. p. 59/342. Add “Administration of justice” and “general government” for 2008.

(4) Towne, Jake. April 2009. “America’s Military Empire.” http://www.nolanchart.com/article6271.html

(5) Marx, Karl. 1848. “Manifesto of the Communist Party” p. 21/44. http://www.marxists.org/archive/marx/works/download/manifest.pdf

(6) Armstrong, Martin. 2008. It’s Just Time. p. 12/77. Contemporary visit and extension of Kondratrieff cycles. http://www.contrahour.com/ItsJustTimeMartinArmstrong.pdf

(7) Rothbard, Murray. 1986. A History of Money and Banking in the United States. p. 240-242/510. http://mises.org/books/historyofmoney.pdf

(8) The First IRS Income Tax Form. 1913. http://www.irs.gov/pub/irs-utl/1913.pdf(9) Federal Reserve Bank of Minneapolis. Inflation calculator. http://www.minneapolisfed.org/

(10) Quinn, James. 2009. “GRAND ILLUSION – THE FEDERAL RESERVE” http://www.nolanchart.com/article6123.html

(11) National Taxpayer’s Union. Who Pays Income Taxes? 2007 figures. http://www.ntu.org/main/page.php?PageID=6

(12) Pennsylvania Department of Revenue. Form PA-40 2008. http://www.revenue.state.pa.us/revenue/lib/revenue/2008_pa-40_fillin.pdf

(13)Towne, Jake. 2009. “The Real Interest Rate.” http://towneforcongress.com/economy/unlocking-the-money-matrix-the-real-interest-rate-part-1215 http://towneforcongress.com/economy/unlocking-the-money-matrix-the-real-interest-rate-part-1215

(14) Edwards, Chris. 2003. “10 Outrageous Facts About the IRS.” Fact #7. http://www.cato.org/pub_display.php?pub_id=3063

(15A) The IRS Tax Code. The IRS strangely recommends visiting Cornell University to view the code and they are correct, it’s easier to view. http://www.irs.gov/taxpros/article/0,,id=98137,00.html#irc

(15B) The IRS Tax Code. Easier to search than the IRS or Cornell version. http://www.fourmilab.ch/uscode/26usc/

(16) The Great IRS Hoax, Chapter 5. http://famguardian.org/Publications/GreatIRSHoax/GreatIRSHoax.htm

(17) IRS 1040 instructions p2/161, http://www.irs.gov/pub/irs-pdf/i1040.pdf

(18) The Constitution of the United States of America. http://www.usconstitution.net/const.html

(19) Benson, Bill. “The Law That Never Was.” http://www.thelawthatneverwas.com

(20) Tax Facts, #1 through #19. http://www.voluntarytax.info/tax_facts1.htm

(21) Brushabervs. Union Pacific Railroad. US Supreme Court, 1916. http://supreme.justia.com/us/240/1/case.html

(22) IRS 1040 instructions p91/161, http://www.irs.gov/pub/irs-pdf/i1040.pdf

(23) Paul, Ron. 2004. “Social Security: House of Cards.” http://www.lewrockwell.com/paul/paul215.html

(24) Gnazzo, Douglas. 2005. “Social Security: The Whole Truth.” http://www.honestmoneyreport.com/archives/2005/truth/part1.html

(25) Paul, Ron. March 2008. “Intervening Our Way to Economic Ruin.” http://www.antiwar.com/paul/?articleid=12519

(26) Towne, Jake. January 2009. “Why Obama’s Stimulus Plan Will Fail… and a Better Alternative.” Idea #1. http://www.campaignforliberty.com/article.php?view=3

(27) Towne, Jake. 2009. “Yes, Virginia, There Are No Reserve Requirements.” http://towneforcongress.com/economy/yes-virginia-there-are-no-reserve-requirements-part-22-1

(28) Joint Committee on Taxation. 2008. “Estimates of Federal Tax Expenditures from 2008-2012.” p. 51-70/77. http://www.jct.gov/s-2-08.pdf

(29) Edwards, Chris. 2007. Testimony to House Budget Committee. p. 4/6 http://budget.house.gov/hearings/2007/02.16edwardstestimony.pdf

(30)Angier, Chuck. 2008. “Why a Fair Tax Won’t Happen.” http://www.nolanchart.com/article2776.html

(31) Internal Revenue Service, Data Book. 2008. p. 72/81. http://www.irs.gov/pub/irs-soi/08databk.pdf

(32)Internal Revenue Service, Budget-in-Brief. FY 2009. p. 2/14. http://www.irs.gov/pub/newsroom/budget-in-brief-2009.pdf

Tags: Internal Revenue, Tax Law, Taxation

I’ve been interested in taxes for longer then I care to admit, both on the personal side (all my working lifetime!!) and from a legal stand since satisfying the bar and following up on tax law. I’ve rendered a lot of advice and righted a lot of wrongs, and I must say that what you’ve put up makes utter sense. Please persist in the good work – the more people know the better they’ll be equipped to comprehend with the tax man, and that’s what it’s all about.

5. Wonderful goods from you, man. I’ve understand your stuff previous to and you’re just extremely great. I really like what you have acquired here, really like what you’re stating and the way in which you say it. You make it entertaining and you still take care of to keep it smart. I can’t wait to read far more from you. This is really a great site.

weiter…

[…]Why the Federal Income-Tax is Unnecessary and Immoral | My Strange Mind[…]…